B2C | Mobile App

Avalara Taxability Matrix

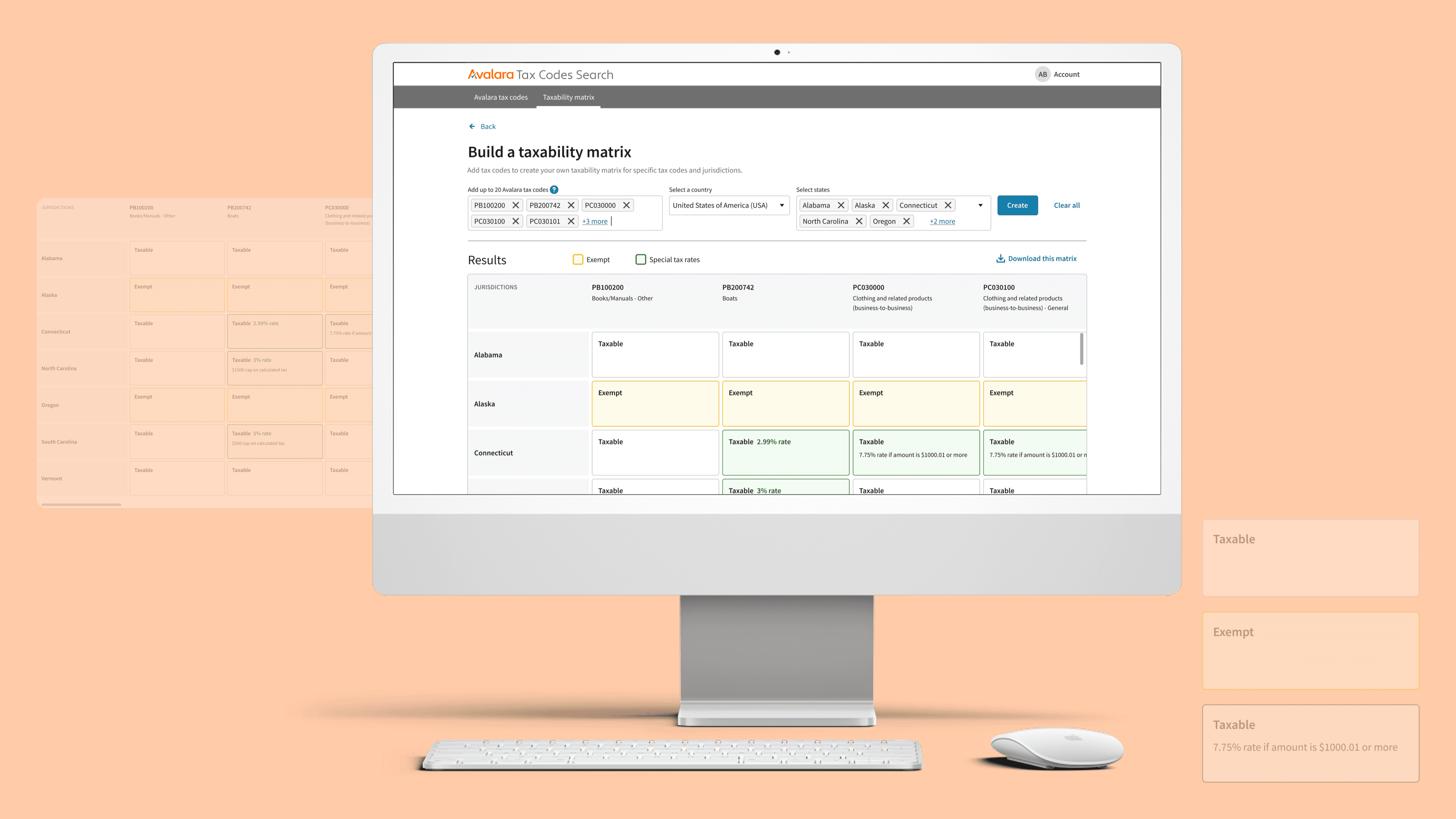

The Avalara Taxability Matrix enables tax professionals and accountants to easily determine whether specific tax codes are taxable or exempt in any U.S. or Canadian jurisdiction, and build their own taxability matrices to streamline compliance. This feature requires a login to AvaTax - Avalara's enterprise software.

Company

Avalara

Role

UX Designer

Duration

Oct 2021 - Apr 2022

Context

Problem

Tax professionals across North America struggle to determine the correct tax code for products and services, especially when taxability varies by jurisdiction (e.g., different states or provinces). Users often found themselves confused about:

Which tax code applies to their invoice product items

Whether a product/service is exempt or taxable in a given jurisdiction

Inability to quickly compare taxability across multiple regions

Heavy reliance on Avalara support or trial-and-error tax filing

Business objectives

Reduce support tickets in Tax code compliance and clarification.

Increase user confidence in tax code selections.

Save user's time by reducing researching complex taxability rules

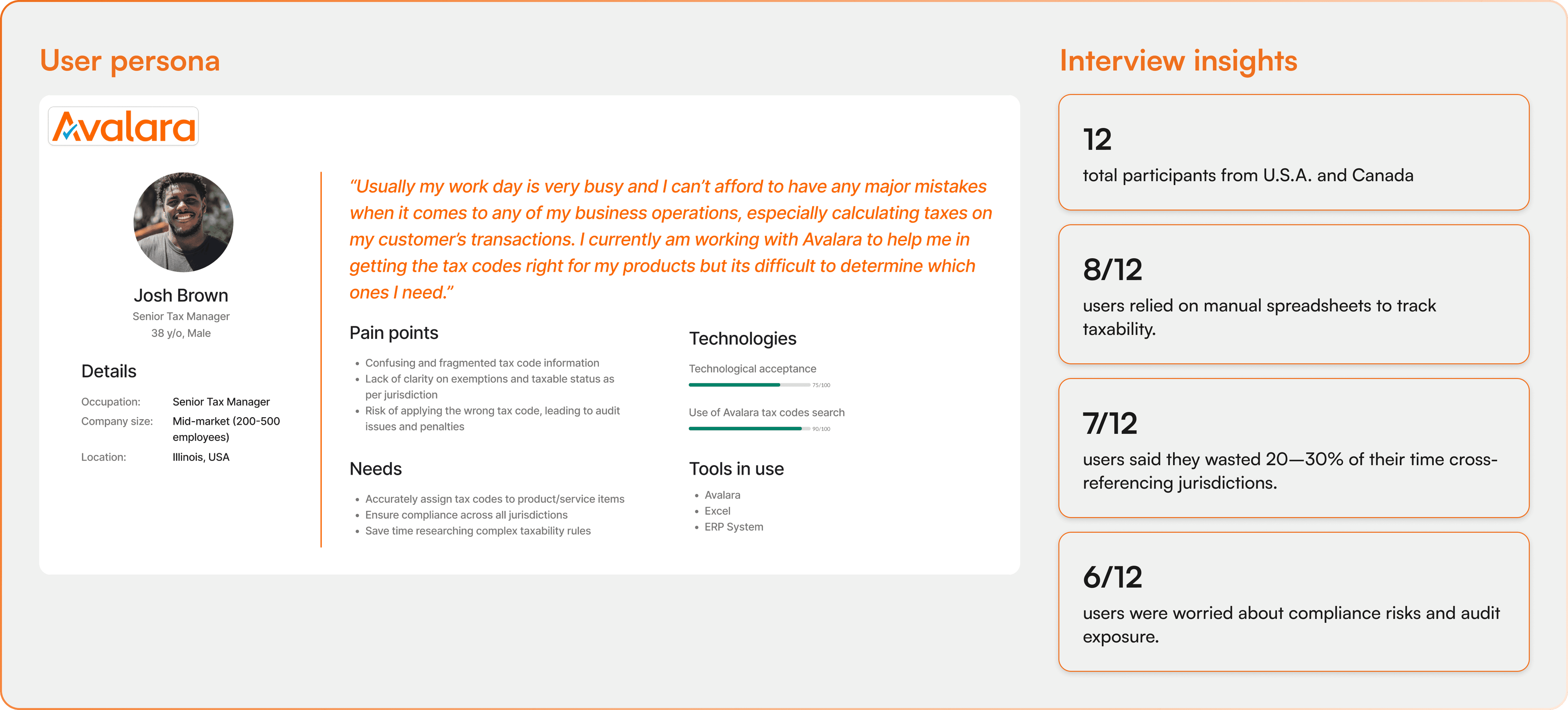

Initial Discovery and User Persona

To start with, I worked with our UX research team where I conducted in-depth interviews with 12 participants: 8 U.S.-based tax professionals and 4 Canada-based tax professionals

Some qualitative insights

“I never feel confident that I’ve picked the right code.”

“Every state has different exemptions—it’s exhausting to keep track.”

“I wish I could just see an excel sheet of all the tax codes with all the jurisdictions where I can find of what’s taxable where.”

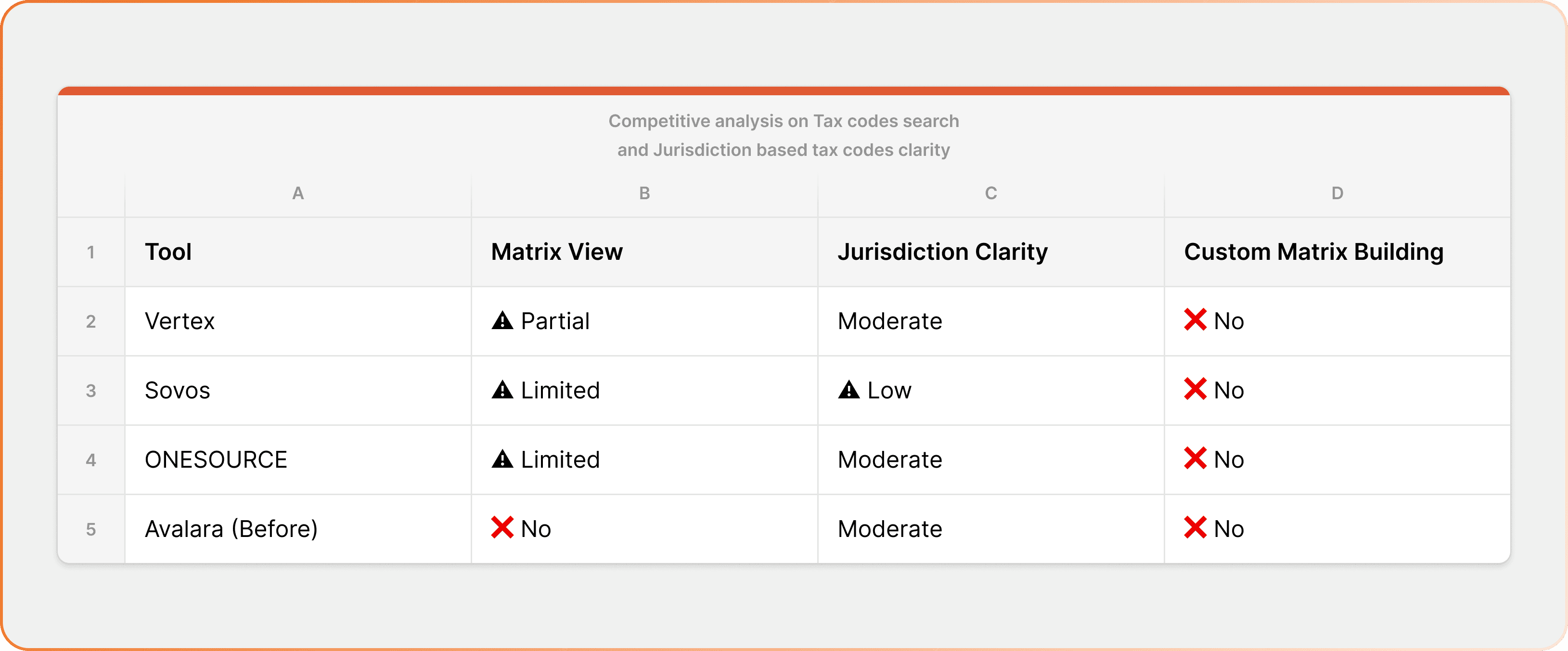

Competitive analysis

I evaluated other tax software (e.g., Vertex, Sovos, Thomson Reuters ONESOURCE). However, none of them offered a robust, user-configurable taxability matrix. And, this was where I recognized that Avalara could differentiate by empowering users to build and export their own matrices.

Brainstorming and Ideation

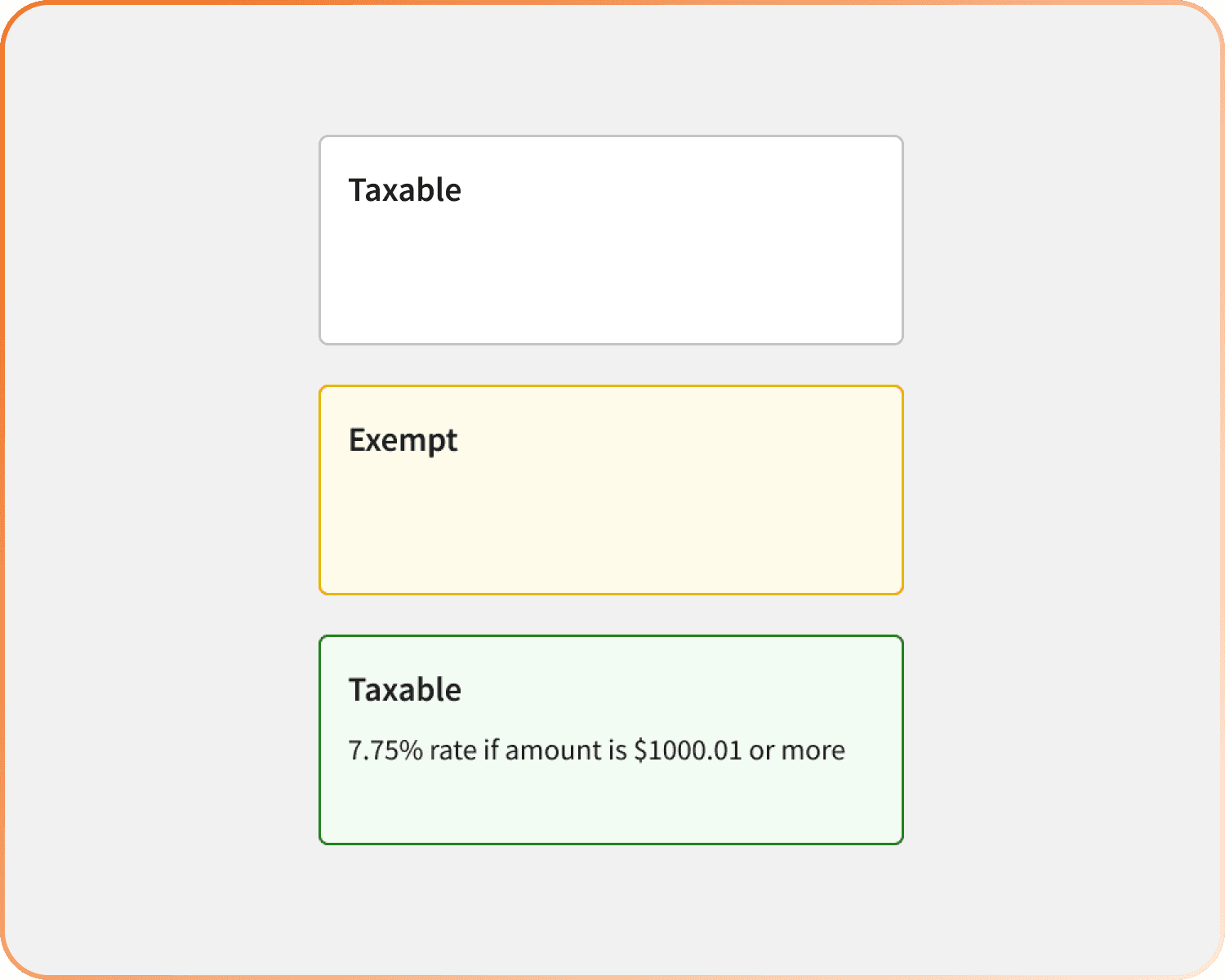

I facilitated stakeholder workshops in which, we explored concepts like static tables, a dynamic matrix builder, Excel export, and jurisdiction filters, ultimately aligning on the dynamic matrix builder, downloadable CSV/Excel, and color-coded statuses (Taxable, Exempt, Conditional).

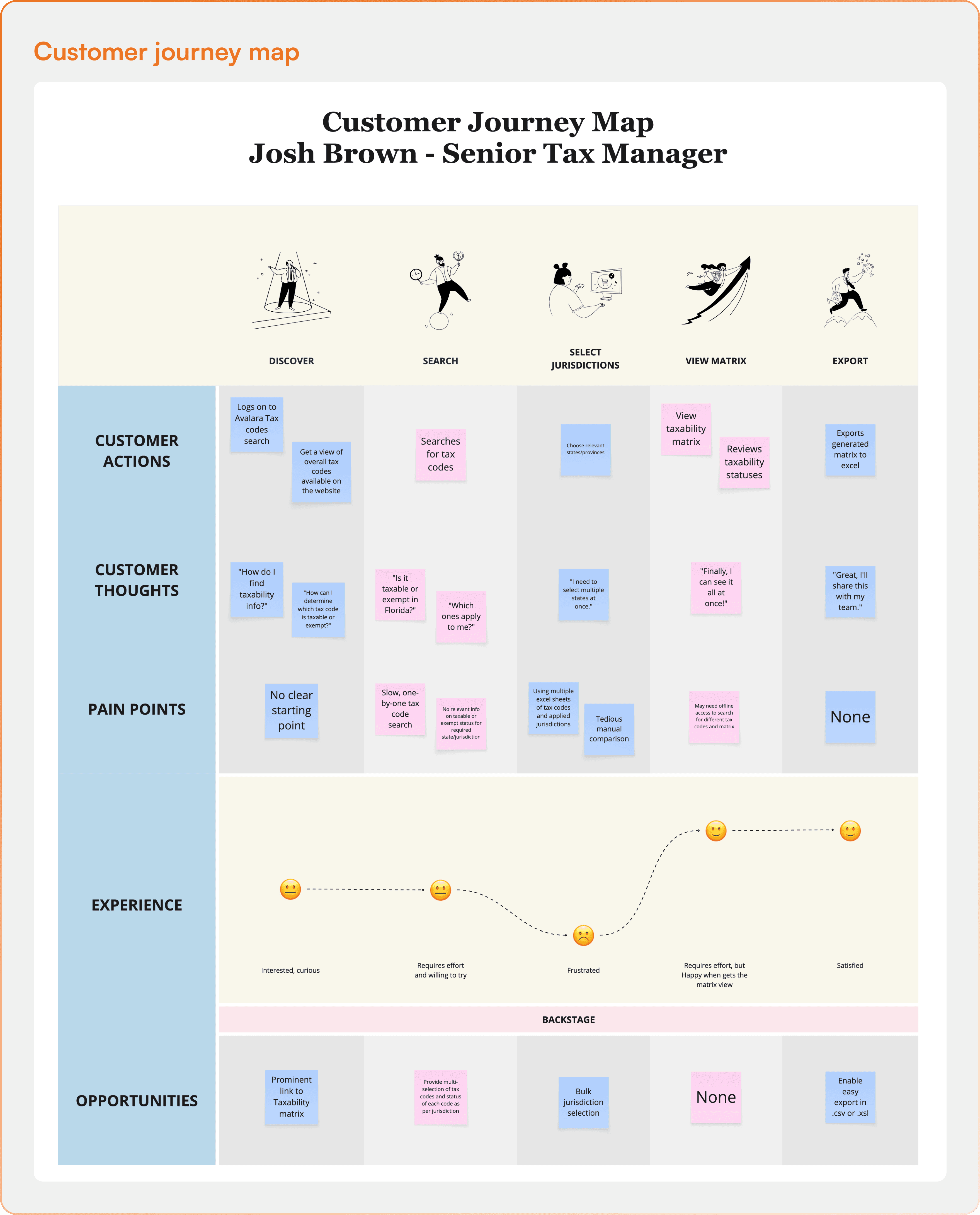

Journey map

I developed a conceptual journey map for a Senior Tax Manager to pinpoint pain points and uncover opportunities in the existing tax code search process, highlighting how the Taxability Matrix can assist in identifying the correct tax codes and their statuses across relevant jurisdictions.

decoding HMWs

How might we reduce decision fatigue around selecting the right tax code?

How might we visualize taxability status across jurisdictions clearly?

Ideas generated

Taxability toggle matrix (Taxable/Exempt/Partial)

Jurisdiction filters (State, Province, City, County)

Save and export personalized matrices

Jurisdiction heatmap (for v2)

API integration with Matrix view (for dev teams)

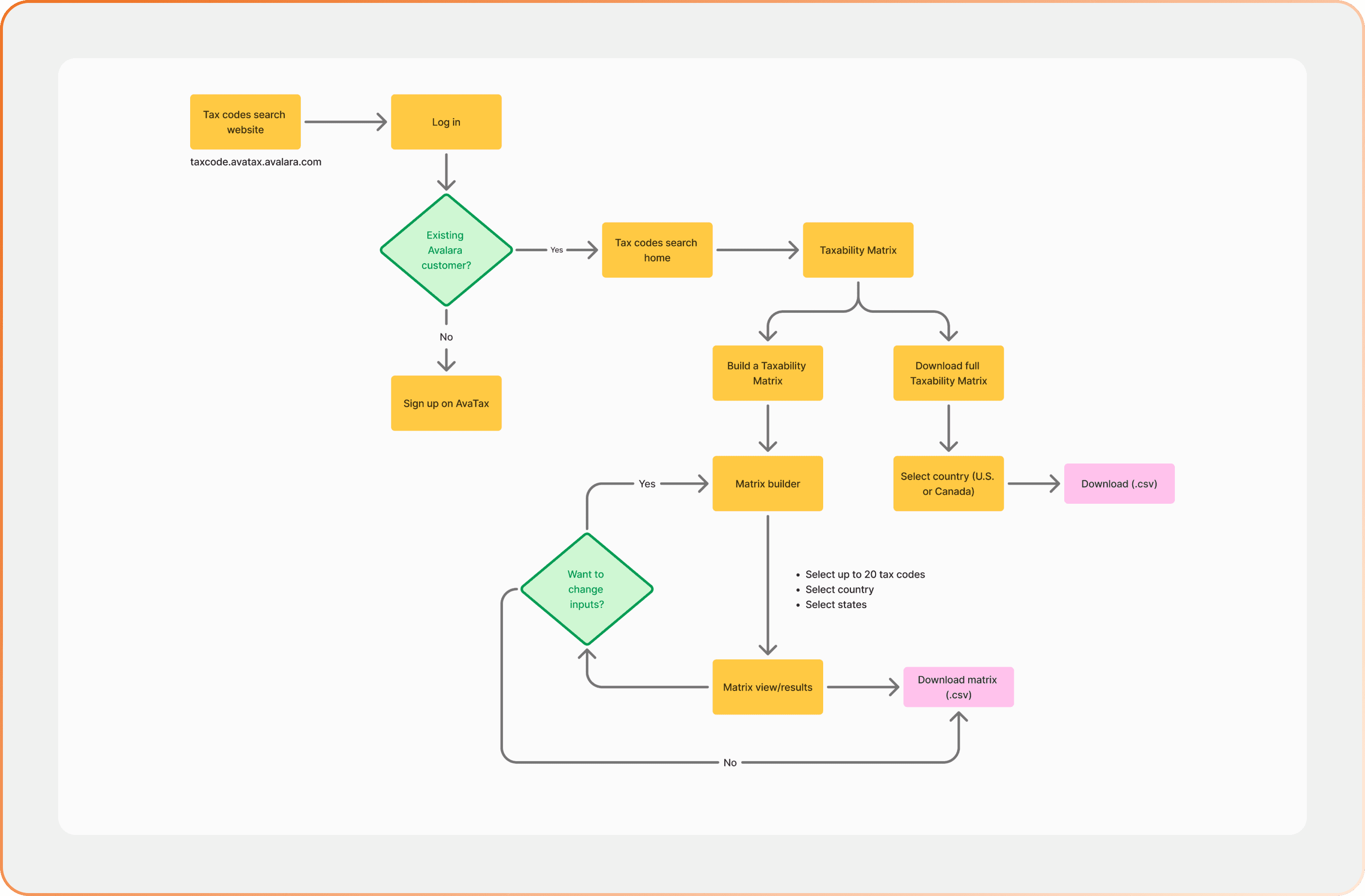

Information architecture

I developed an information architecture to plan the design and implementation of the new Taxability Matrix feature for tax managers and professionals. This provided clarity on the intended user interactions for building a Taxability Matrix.

Design Solution

I outlined a design solution for Taxability Matrix that includes several features like multi-select tax code search, bulk jurisdiction selection, color-coded statuses (Taxable, Exempt, Conditional) and easy Excel/CSV export.

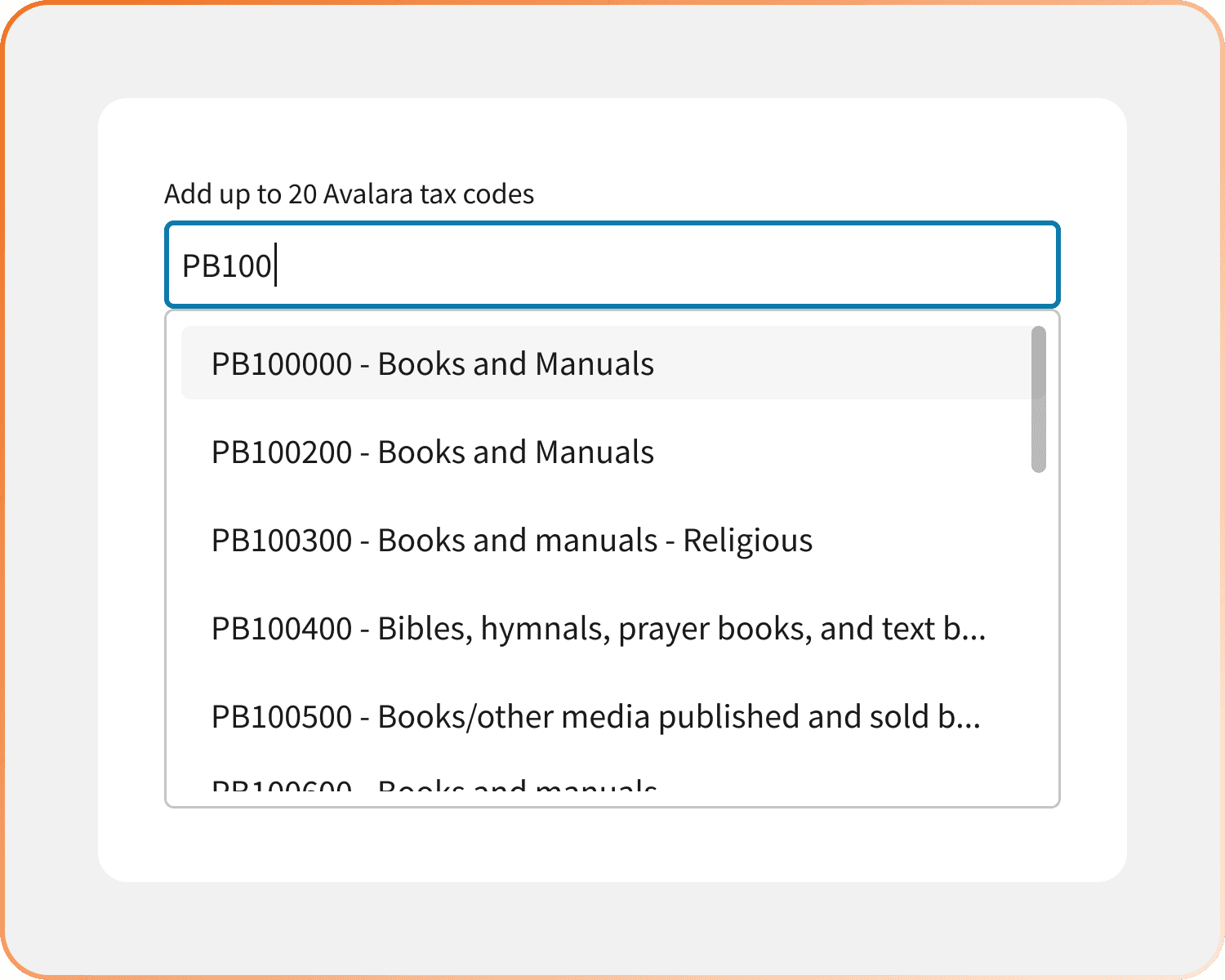

Muti-select tax codes search

I designed a custom multi-selector for the Taxability Matrix, allowing users to choose multiple tax codes and jurisdictions in the U.S. or Canada simultaneously. This enabled us to create a 2D matrix displaying each tax code with its Taxable or Exempt status by jurisdiction.

For this, I've created a local, team-tier multi-select component based on Avalara's existing Skylab Design System.

Color coded taxability statuses

I applied color coding to help users quickly identify whether tax codes are taxable, exempt, or conditionally taxable within each jurisdiction.

Final prototype

Taxability matrix in action!

Outcomes and Impact

I did a SUS scoring (System Usability Scale) with 5 participants on the new Taxability Matrix experience under tax code search. We also achieved some KPIs through the feature launch.

75.5

improved System Usability Scale (threshold - 68)

<5 mins

time to determine the correct tax code and its status

60%

reduction in support tickets

High

confidence in tax compliance